Credit Card Attrition

Overview

Our bank has recently launched a range of premium credit card offerings, encompassing the Blue, Silver, Gold, and Platinum tiers. However, we have observed a notable uptick in customer attrition across these products in recent months. It is imperative for us to delve into the underlying factors driving this attrition, identify the customer segments most affected, and devise strategic measures to mitigate this trend effectively

Project Objective

Our ProjectKey Findings

Analysis

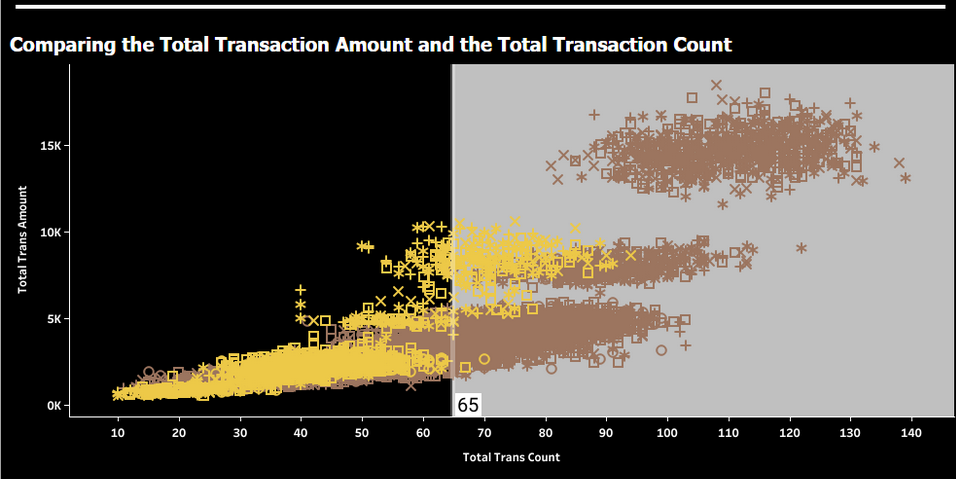

- During the comparison of the Total Transaction Amount and Transaction Count, three distinctive clusters were observed.

- The average transaction count across our entire customer base is 65.

- Within these clusters, an initial cluster was identified where customers spend below £5,000, and this cluster has the highest number of attrited customers.

- Investigation into whether these clusters were formed by credit limits was conducted, utilizing shares to evaluate various credit limits.

- Observation indicates that these clusters are not created by credit limits, as there is a mix of all credit limits in every cluster.

Inference

- The presence of three distinctive clusters suggests varying spending patterns among customers.

- The cluster with transactions below £5,000 and the highest number of attrited customers indicates a potential correlation between lower spending levels and attrition.

- The analysis indicates that credit limits alone do not explain the formation of these clusters, implying that other factors contribute to customer behavior and attrition risk.

- Customers with transaction counts below the average and monthly spending below £5,000 are identified as a high-risk group for attrition, highlighting the importance of targeted retention strategies for this segment.

Recommendation

- Re Engagement Strategies for 40-60+ Age Range:

- Implement targeted reengagement strategies for customers aged 40-60+ who exhibit prolonged periods of inactivity.

- Develop personalized promotions, loyalty programs, or special offers tailored to their preferences and spending habits to encourage renewed engagement.

-

Segment-Specific Retention Strategies for High-Risk Groups:

- Develop targeted retention strategies tailored to customers with transaction counts below the average and monthly spending below £5,000.

- Implement personalized initiatives to enhance engagement and loyalty among this high-risk group for attrition.

-

Transition Period Monitoring (Q4 to Q1):

- Monitor spending trends closely during the transition from Q4 to Q1 and adjust marketing strategies accordingly.

- Consider offering post-festive season promotions or incentives to sustain customer engagement and spending momentum into the new year.

-

Personalized Retention Initiatives Based on Relationship Counts:

- Develop personalized retention initiatives based on relationship counts to enhance customer engagement and loyalty.

- Implement targeted promotions or rewards programs tailored to the specific needs and preferences of customers with varying relationship counts.

These recommendations are designed to leverage identified patterns and correlations to formulate targeted strategies for customer retention and engagement, addressing specific needs and behaviors observed within the customer base.