Bank Loan Dashboard

Overview

In order to monitor and assess our bank's lending activities and performance, we need to create a comprehensive Bank Loan Dashboard. This Dashboard aims to provide insights into key loan-related metrics and their changes over time. It will help us make data-driven decisions, track our loan portfolio's health, and identify trends that can inform our lending strategies.

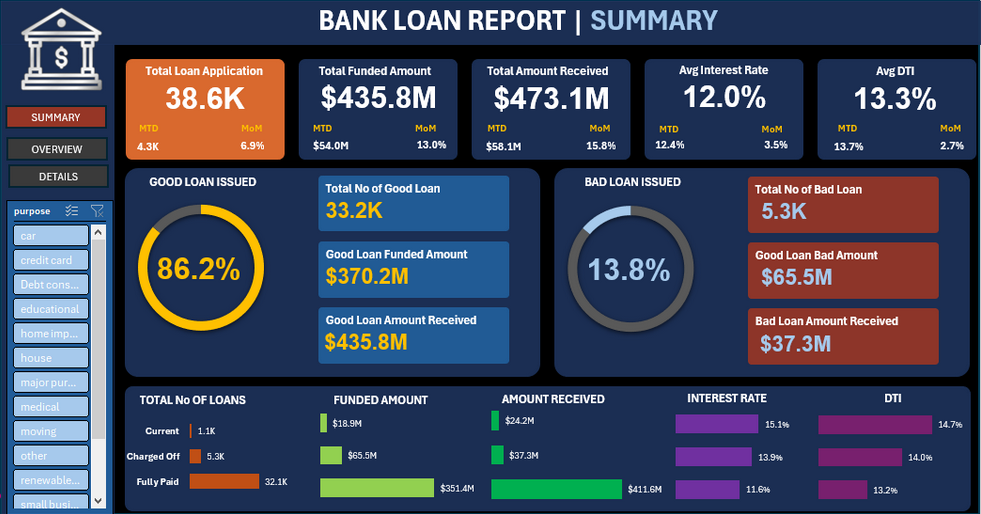

Dashboard 1: Summary

Key Performance Indicators (KPIs) Requirements:

1. Total Loan Applications

2. Total Funded Amount

3. Total Amount Received

4. Average Interest Rate

5. Average Debt-to-Income Ratio (DTI)

Good Loan v Bad Loan KPI’s

Good Loan KPIs:- Good Loan Application Percentage

- Good Loan Applications

- Good Loan Funded Amount

- Good Loan Total Received Amount

Bad Loan Application Percentage

- Bad Loan Applications

- Bad Loan Funded Amount

- Bad Loan Total Received Amount

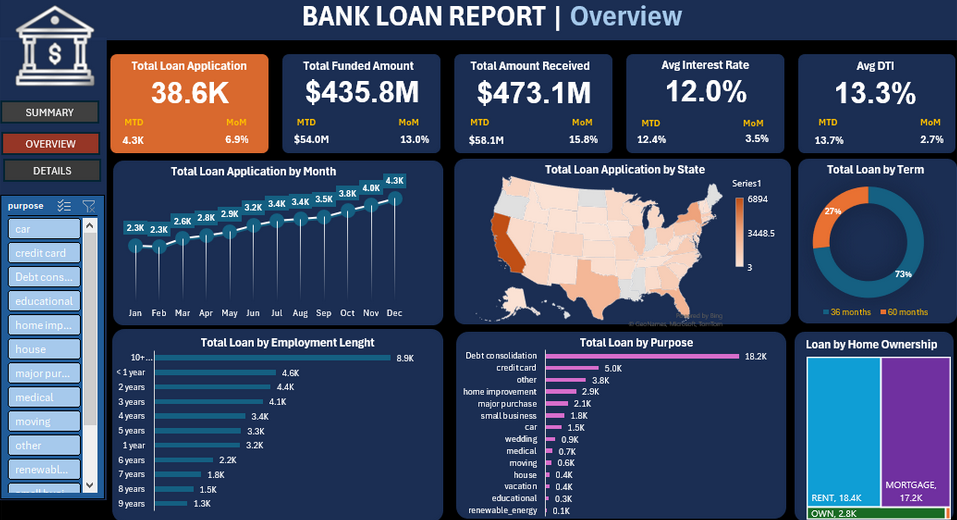

Dashboard 2: Overview

In our Bank Loan Report project, we aim to visually represent critical loan-related metrics and trends using a variety of chart types. These charts will provide a clear and insightful view of our lending operations, facilitating data-driven decision-making and enabling us to gain valuable insights into various loan parameters.

Chart Requirements:1. Monthly Trends by Issue Date (Line Chart)

2. Regional Analysis by State (Filled Map)

3. Loan Term Analysis (Donut Chart)

4. Employee Length Analysis (Bar Chart)

5. Loan Purpose Breakdown (Bar Chart)

6. Home Ownership Analysis (Tree Map)

Key Findings

- Positive Growth Trends:- There is a consistent month-over-month increase in key metrics such as Total Loan Applications, Total Funded Amount, Total Amount Received, Average Interest Rate, and Average Debt-to-Income Ratio (DTI).The rise in the percentage of "Good Loans" (Current and Fully Paid) indicates a healthy loan portfolio.

- Portfolio Health:- Most of the 32.1k loan applications fall under the category of Fully Paid, reflecting a positive repayment trend. The number of Current Loans (1.1k) is notably smaller than Fully Paid Loans, suggesting a need to focus on increasing the proportion of current loans.

- Charged Loans Analysis:- Charged Loans amount to 5.3k, indicating a segment that needs attention. While the Average Interest Rate on Current Loans is 15.1%, Charged Loans have a slightly lower rate of 13.9%.

- Debt-to-Income Ratio Insights: - The Average Debt-to-Income Ratio is 14.7%, suggesting borrowers generally have a healthy balance between debt and income. Notably, the Charged Off Loans have a similar average ratio of 14%, implying a need for closer scrutiny in evaluating borrower financial health.

- Purpose and Home Ownership Influence: - Debt Consolidation is the highest loan purpose (18.2k), indicating a common financial goal among borrowers.Mortgage and Rent categories contribute significantly to the home ownership profile (17.2k), highlighting a need to tailor loan offerings to these segments.

- Loan Term Distribution:- The majority of loans have a term of 36 months (73%), with 27% having a 60-month term. This suggests a preference for shorter-term commitments, aligning with a potential strategy for more flexible loan terms.

Recommendations

- Optimize Current Loans:- Implement strategies to increase the number of current loans, providing incentives for timely payments and customer engagement.

- Risk Management for Charged Loans:- Conduct a thorough risk assessment of Charged Loans to understand the factors contributing to charge-offs. Consider targeted interventions, such as revised interest rates or personalized financial counseling, to mitigate risk in this segment.

- Debt Consolidation Specialization:- Given the popularity of debt consolidation, tailor marketing efforts and loan products to cater specifically to borrowers seeking debt consolidation.

- Home Ownership-Centric Approach:- Customize loan offerings based on the prevalent home ownership profiles (e.g., Mortgage and Rent), aligning with the financial needs and capabilities of these segments.

- Flexibility in Loan Terms:- Acknowledge the preference for shorter-term commitments and explore options for flexible loan terms to attract a wider customer base.

- Continuous Monitoring and Analysis: - Establish regular monitoring mechanisms to track changes in key metrics, enabling proactive decision-making and adapting strategies based on evolving trends.

These recommendations aim to enhance portfolio health, mitigate risks, and align lending strategies with the evolving preferences and needs of borrowers.